In the Picture

Bid rigging: Winning by losing (together)?

February 2026Imagine...

You work for a large European event‑planning company, and you are preparing a bid for a major tender launched by the European Commission. At a trade fair, an acquaintance from a competing company tells you he expects that only your two companies are capable of bidding for this tender. He suggests a “solution”: only one of you will submit a bid and afterwards subcontract part of the project to the other, allowing both to profit from the tender.

You immediately call your external legal counsel, who advises you to end the conversation straight away, to clearly reject the proposal, and to avoid any further discussion.

You wonder why your external legal counsel reacted so strongly. After all, what’s the problem with working together with a competitor on a large project?

A brief clarification.

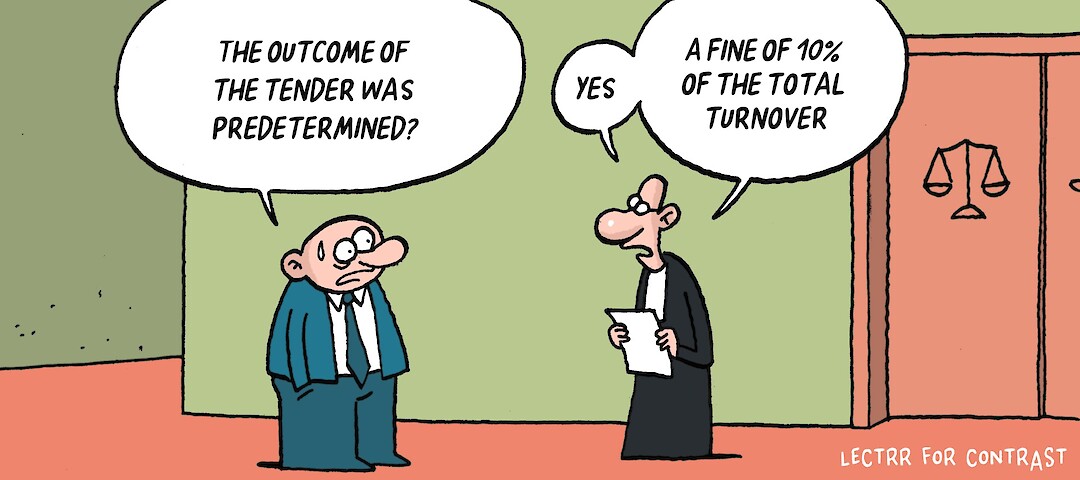

What your acquaintance was offering actually wasn’t a simple and legitimate cooperation. It was bid rigging. Bid rigging is a practice by which competitors collude to predetermine the outcome of tenders, either public or private.

Bid rigging takes several common forms:

- Bid suppression: where one candidate agrees with another not to bid on a specific tender.

- Cover bidding: where one candidate agrees with another to submit an artificially high bid (a so-called cover offer); and

- Bid rotation: where candidates agree beforehand not to bid or to submit only artificially high bids in rotation, ensuring that each party will obtain a number of contracts of a similar value.

Bid rigging removes the strategic uncertainty that ensures that bidding parties submit competitive bids for tenders. By knowing that other companies will not really try to compete for a tender, a candidate knows that it may inflate its prices and still win the tender.

Bid rigging is illegal under EU competition law. Companies that are found guilty of bid rigging may receive a fine totalling up to 10% of their worldwide turnover. Bid rigging is also a criminal offense in some European countries, such as Belgium, Germany and France.

Both the European Commission and national competition authorities have in the past imposed heavy fines on companies guilty of bid rigging. A notable example are the fines imposed by the Commission on companies manufacturing lifts and elevators (a total of 992 million euros), or recently the fine imposed by the Belgian Competition Authority ('BCA') on companies active in the press distribution sector (a total of 12 million euro).

Several national competition authorities indicated very clearly that they will continue to devote considerable resources to combat bid rigging. In line with this commitment, the BCA recently published a draft guide for public authorities to stimulate competition and prevent anticompetitive practices in the context of public tenders. The BCA has opened a consultation on this draft guide, interested parties may submit their contributions until 28 February 2026.

So, what does this mean for the large event-planning company mentioned in our introduction? Does this mean that any cooperation with a competitor in the context of a tender is prohibited?

No. Competitors may, under strict competition law conditions and safeguards, form a consortium or submit a joint bid for a specific tender. A tenderer may also subcontract part of its responsibilities to a competitor. However, these practices should be limited to cases where the companies involved truly combine complementary capacities to deliver a project which they could not realistically perform alone considering the circumstances of the project, such as the size and capabilities of the company, the level of financial risk as well as the level of the investments required for the project. Companies contemplating cooperation with a competitor in the context of a tender must thus ensure that this cooperation is indispensable and cannot be seen as a form of agreement to predetermine the result of the tender. Information sharing between members of a consortium or a tenderer and a subcontractor should also be kept on a necessity and need-to-know basis.

Companies who regularly participate in tender procedure are well advised to train the relevant teams on the pitfalls to avoid from a competition law perspective. In case you suspect that your company has been involved in a potential case of bid rigging, or if a competitor has approached you to offer to collude in the context of a tender, consult legal counsel immediately for the next steps.

Concretely.

- Participate in tenders independently from competitors.

- Collaborate with competitors only if your company is not realistically capable of competing in a tender procedure individually and limit information sharing to the employees who are involved in the project (need-to-know principle) and to the information which is necessary for this project (necessity principle).

- Train relevant teams about the risks of bid rigging and prohibited practices.

- Contact legal counsel when contemplating cooperation or if you suspect potential bid rigging.

Want to know more?

Please consult our website or contact one of our team members if you have questions or require more information: